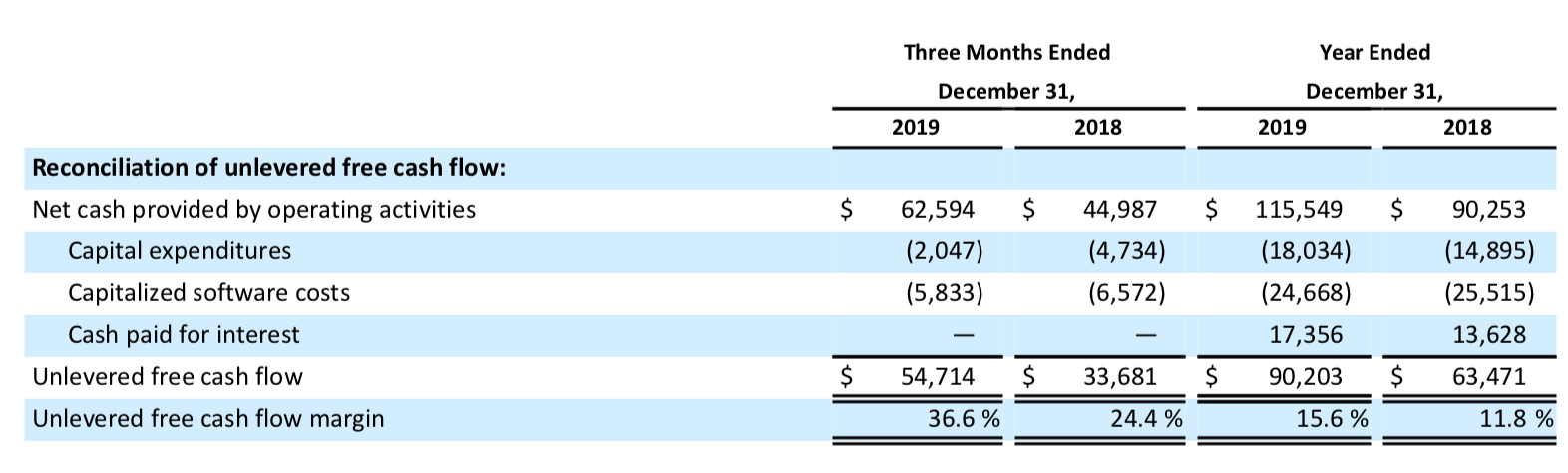

unlevered free cash flow margin

At its most basic unlevered free cash flow is the cash available to all capital investors without taking into account any interest payments due on the outstanding capital debt. While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors.

Unlevered Free Cash Flow Definition Examples Formula

Margin tells us what portion of sales ends up as FCF.

. The trend continues when. FCF Margin 1q 5446 41159 100 1323. Both metrics will appear on the balance sheet and for many companies the difference between levered and unlevered free cash flow is an important indicator of financial health in and of itself.

Our objective in our Excel model is to value the company MarkerCo by discounting the cashflows in their financial statement projections. Each is critical especially to potential partners investors or anyone interested in buying your company. Most information needed to compute a companys FCF is on the cash flow statement.

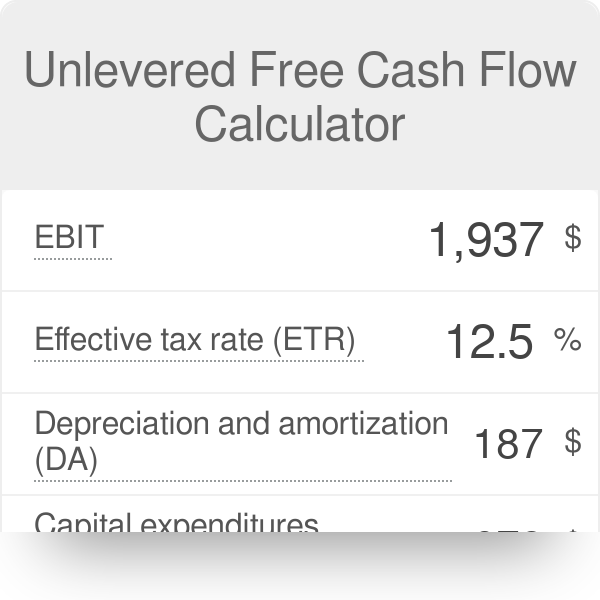

As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560. Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator. FCFF EBIT - Taxes Depreciation Amortization - Change in Working Capital -.

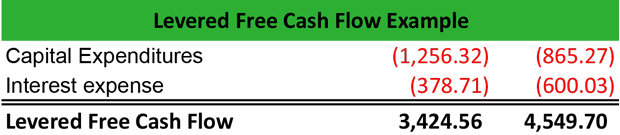

Means total Unlevered Free Cash Flow for the current fiscal year minus the Board-approved pro forma Unlevered Free Cash Flow for Target for the current fiscal year total Revenue for the current fiscal year minus the Board-approved pro forma Revenue for Target for the current fiscal year minus one 1. Levered free cash flow is the amount of cash that a company has remaining after accounting for payments to settle financial obligations short and long term including principal repayments. This is because the difference shows how many financial.

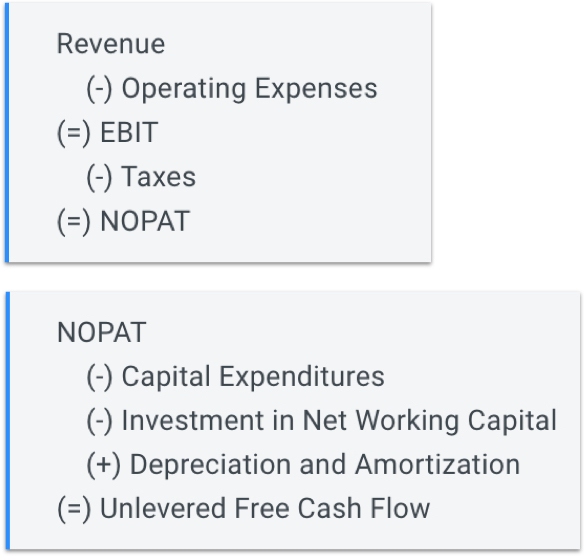

And we know that NOPAT EBIT 1 Tax Rate. The look thru rule gave qualifying US. Discounted Cash Flow DCF Overview Weighted-Average Cost of Capital.

A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy. In short unlevered free cash flow is the gross free cash flow generated by a business. The formula below is a simple and the most commonly used formula for levered free cash flow.

A complex provision defined in section 954c6 of the US. This is helpful in comparing the free cash situation of different companies on an apples-to-apples basis. The easiest way to do this is to calculate the enterprise value of the company and then calculate the equity value.

The formula to calculate the unlevered free cash flow for a company is the following. Therefore youll find that unlevered free cash flow is higher than levered free cash flow. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash Working Capital.

To calculate a companys UFCF you must first. The margin will be higher for unlevered FCF than for levered if the company has any debt. Levered free cash flow assumes the business has debts and uses borrowed capital.

Unlevered and levered cash flow will appear on your balance sheet as separate items. Lets calculate the free cash flow for Google Alphabet FCF Operating Cash Flow Capital Expenditures. Internal Revenue Code that lowered taxes for many US.

One way to look at a companys performance is to calculate the unlevered free cash flow for the time period in question. Margin Free Cash Flow Revenue 100. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

The formula for UFCF is. This represents the companys earnings from core business after taxes ignoring capital structure. Free cash flow indicates gross cash flow rather than net.

Free cash flow margin simply takes the FCF and compares it to a companys sales or revenue. How to Calculate Unlevered Free Cash Flow. Unlevered free cash flow on the other hand produces the higher absolute returns but relatively low alpha.

Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. Unlevered Free Cash Flow Margin Unlevered Free Cash Flow Total Revenue 241 27078 B 1123 B. There are various ways to compute for FCF although they should all give the same results.

Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing. It is also referred to as levered cash flow and abbreviated as LFCF. For the quarter ended in March 2020.

By tying FCF to a percentage of sales we can understand the margins profile and get context on how efficient a company is on a FCF basis. The formula to calculate unlevered free cash flow margin and an example calculation for Meta Platformss trailing twelve months is outlined below. EBIT Operating income income statement t tax rate computed by dividing income taxes by EBIT.

The formula for unlevered free cash flow also known as free cash flows to firm FCFF is. Free cash flow is the amount of money left over when all outflow is subtracted. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115.

The formula to calculate unlevered free cash flow margin and an example calculation for Costco Wholesales trailing twelve months is outlined below. Unlevered Free Cash Flow Margin Unlevered Free Cash Flow Total Revenue 05 957 M 2031 B The tables below summarizes Costco Wholesales performance over the last five years. Putting Together the Full Projections.

Now we shall determine FCF. When performing a discounted cash flow with levered free cash flow - you will. FCF 1q 11451 6005 5446.

Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. The goal of this lesson is to calculate the Unlevered Free Cashflow for MarkerCo. How Do You Calculate Unlevered Free Cash Flow.

Investors perceive businesses with positive LFCF as financially healthy. Free Cash Flow Operating Cash Flow CFO Capital Expenditures. Free Cash Flow Margin.

For the quarter ended in June 2020. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes.

How to calculate unlevered free cash flow. Define Unlevered Free Cash Flow Margin. It is also thought of as cash flow after a firm has met its financial obligations.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Free Cash Flow Calculator Ufcf

Free Cash Flow To Firm Fcff Formulas Definition Example

Discounted Cash Flow Analysis Street Of Walls

Cornerstone Ondemand It S Now About The Cash Flow Nasdaq Csod Seeking Alpha

Discounted Cash Flow Analysis Street Of Walls

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

What Is Levered Free Cash Flow Definition Meaning Example

Fcf Formula Formula For Free Cash Flow Examples And Guide

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

What Is Levered Free Cash Flow Definition Meaning Example

Fcf Yield Unlevered Vs Levered Formula And Calculator